INSIGHTS

Balance Sheet

Ecem Bozkurt Yeşiltaş

30.01.2023

What Is the Balance Sheet?

The term we call balance sheet actually refers to a financial statement that reports all of a company’s assets, liabilities and shareholders’ equity at a given point in time. Balance sheets provide a basis for investors in calculating companies’ rates of return and evaluating a company’s capital structure. In brief, we can say that the balance sheet is a financial statement that provides a snapshot of the amount invested by shareholders, apart from what a company owns and owes.

How Do Balance Sheets Work?

When creating balance sheets, assets are written on one side and liabilities and equity on the other. The following accounting equation is created by these two parties and is balanced by adhering to this equation:

• All assets = all Liabilities + Shareholders’ Equity

This formula is an intuitive formula. This is because all assets owned by a company have to be paid for by borrowing or buying stock from investors.

What Are the Components of a Balance Sheet?

As we mentioned in the previous title, there are 3 components of the balance sheet: assets, liabilities and shareholders’ equity. Let’s consider these in more detail:

Assets:

The term we call assets includes both current assets and fixed assets.

Current Assets: It includes cash and cash equivalents, such as short-term government bonds, treasury bills, and money market funds, accounts receivable and inventory.

Fixed Assets: Includes already owned properties, factories, equipment, long-term investments and intangible assets such as patents and licenses.

Liabilities:

Liabilities are simply the opposite of assets. It is divided into two as short-term liabilities and long-term liabilities.

Current Liabilities: It consists of all accounts payable, bills to be paid within the year and current maturities of long-term debts.

Non-current Liabilities: Refers to long-term debt securities, deferred tax liabilities, bonds payable and long-term debt.

Shareholders’ Equity:

Also known as stockholders’ equity, refers to the amount of money the owners have invested in the business. It is divided into two as share capital and retained earnings.

Share Capital: It refers to the amount of money that any company receives from its shareholders for business purposes.

Retained Earnings: It refers to the amount of a company’s profits that are not distributed as dividends to shareholders.

Why Is a Balance Sheet Important?

The balance sheet is a very important element for a company because it shows business owners and investors everything a company owns and owes during a given period. A balance sheet for a typical accounting period, 12 months, reflects the number of all assets and liabilities at the end of the period. Although balance sheets are often used to track earnings and expenditures, they also reflect the profitability of a business to those interested in buying shares.

Limitations of a Balance Sheet

Just like any other financial statement, the balance sheet has several limitations that can hinder effective decision making. These are as follows:

• Qualitative Inputs cannot be evaluated

• Long-term assets may be under-stated

• Figures can be misrepresented

• Many intangible assets are subjectively reported

• It does not report the current value of an item all the time

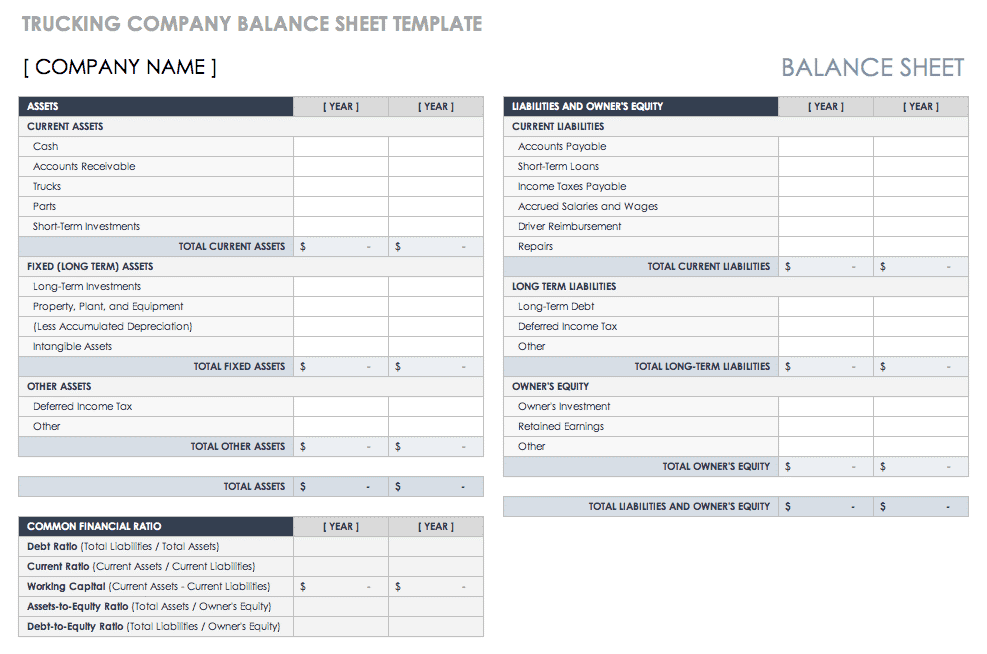

Example of a Balance Sheet

What is Included in the Balance Sheet?

The balance sheet contains information about all the assets and liabilities of a company. Just as we mentioned in the previous titles, depending on the company, this may include short-term assets such as cash and accounts receivable, or long-term assets such as property, plant and equipment. Likewise, all liabilities of the company include short-term liabilities such as accounts payable and fees payable, or long-term liabilities such as bank loans and other debt obligations of the company.

Who Prepares the Balance Sheet?

Although it may vary from company to company, different parties may be responsible for the preparation of the balance sheet. For example, for small private businesses, the balance sheet may be prepared by the owner or a company accountant. Likewise, for medium-sized private firms, it can be prepared internally and then reviewed by an external accountant.

What Are the Uses of a Balance Sheet?

Some of the uses of the balance sheet are as follows:

To Determine If Working Capital is Enough:

The balance sheet is used to see if the business has sufficient working capital to continue its operations.

To Determine the Business Net Worth:

The concept called ‘Net Worth’ is defined as the true value of an asset. It shows how rich or poor you are. This in turn is calculated through total assets minus total liabilities.

To See If the Company Can Sustain Future Operation:

By looking at the balance sheet, people can gain insight into whether a company will continue to operate in the future.

To Identify If There’s Possible Issuance of Dividend:

Most business owners or investors want to know clearly when they will get a return on their investment. Such company returns can be in the form of dividends. A dividend is given if the company is making a profit and the retained earnings are high.